Financial Aid Help

We’re here when you need us.

Financial Aid Help

First time applying for financial aid? We’re specialists in making financial aid a lot less scary. After you apply to PTC, you’ll be assigned a financial aid counselor who will answer your questions and offer as much support as you need. Below you will find the most common funding sources, but these are not your only options.

At PTC, there are no long lines behind financial aid counters, no long waits to get the answers you need. Only personal attention, every time you need it.

If you have questions about any step in the financial aid process, remember, we are here to help.

| Thomas Shiel Financial Aid Counselor / Veteran SCO | 412-809-5131 |

| Mary Lou Heinrich Financial Aid Counselor | 412-809-5147 |

| Jan Seabright Financial Aid Counselor | 412-809-5140 |

| Megan Lee Director of Financial Aid | 412-809-5191 |

Let’s tackle the new FAFSA together.

There’s good news—the 2024-25 FAFSA is shorter and more streamlined, and will mean that more students qualify for PELL grants, which are not paid back.

But it gets even better, especially when a PTC Financial Aid Counselor works with you, one on one, to complete it. That’s why we’re holding F⌕cus on FAFSA workshops on our campus. Come with all of your questions. And come hungry—we’ll feed you, too!

Access the Federal Student Aid Estimator through the link below to determine the federal student aid amount you may be eligible to receive for the upcoming 2024–25 award year.

Note: This tool estimates the Student Aid Index (SAI) for the 2024–25 award year, not the Expected Family Contribution (EFC) for the 2023–24 award year.

Step 1: FSA ID

Start by obtaining a Federal Student Aid Identification (FSA ID) at: studentaid.gov.

Several of the government forms require you to sign electronically with a FSA ID (Federal Student Aid ID). If you follow the link to this government website you may create your FSA ID.

The process only takes a few minutes. Once you create your FSA ID, it should be authenticated within 72 hours. You will need this FSA ID to electronically sign your forms. If you are a dependent student, both you and one parent must create a FSA ID. To create a FSA ID, both you and your parent must have different cell phone numbers and email addresses. If you are not sure if you are a dependent student, check this site: studentaid.gov/apply-for-aid/fafsa/filling-out/dependency.

Step 2: Complete the FAFSA

Complete the FAFSA at: studentaid.gov.

The FAFSA form is the Free Application for Federal Student Aid. Once you create your FSA ID you will be able to electronically sign the FAFSA and loan applications.

- If you will be starting college after July 1, 2023, complete the 2023-24 FAFSA application.

- If you will be starting college in January or April 2024, complete both the 2023-24 AND the 2024-25 FAFSA applications.

- If you will be starting college after July 1, 2024, complete the 2024-25 FAFSA application.

- Having your completed 2021 and 2022 IRS 1040 and W2’s handy will help with the FAFSA application process. Most of the income questions are found on the federal IRS 1040 and W2’s.

- Completion of the 2023-24 FAFSA requires information from your 2021 IRS Tax Forms.

- Completion of the 2024-25 FAFSA requires information from your 2022 IRS Tax Forms.

- If you are a dependent student, you will want to have both yours and your parent’s federal tax returns handy.

- PTC’s Federal School Code is 007437. You will need this to ensure that the results of your FAFSA application are sent to PTC.

- The FAFSA application should take about 30 minutes.

- If you need to stop in the middle of the application, remember to SAVE your work.

Step 3: State of Pennsylvania Financial Aid

Residents of the state of Pennsylvania have a number of financial aid opportunities through the Commonwealth of Pennsylvania. These programs are administered through the Pennsylvania Higher Education Assistance Agency (PHEAA).

To apply for a PA state grant, link to the PA state grant application directly from your FAFSA confirmation page prior to logging out of the FAFSA or go to www.aessuccess.org.

You will need to create your PA state grant account access to complete the state grant form.

To learn more about grant opportunities visit http://www.pheaa.org.

Some PA State grant options include:

Step 4: Federal Direct Student/Parent Loans

There are a number of financial aid opportunities available to PTC students. After you have completed the FAFSA, the next step is to consider applying for a Federal Direct Student Loan at studentaid.gov and Parent Plus Loan. On this site you will find loan options, information on repayment plans, interest rates and other important information. Plan for about 20 minutes to complete these applications.

Students:

- Use the student FSA ID to sign in to the site.

- Complete the Master Promissory Note for undergraduate students.

- Select the subsidized/unsubsidized option.

Parents:

- Use the parent FSA ID to sign in.

- Complete the parent PLUS loan credit check.

- Select PLUS loans: Grad PLUS and Parent PLUS.

- Complete the Master Promissory Note form.

- Select Parent PLUS for undergraduate students.

Once you apply to PTC and complete the financial aid steps above, log in to your Financial Aid Portal for financial aid updates, to complete financial aid documents, access completed documents, review and accept federal financial aid rewards, and monitor when financial aid awards are disbursed.

You will not be able to access the financial aid portal until you are accepted at PTC.

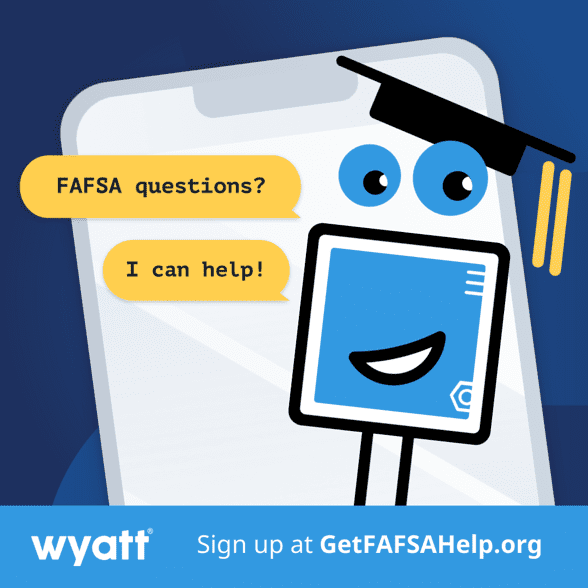

FAFSA got you stuck? Let Wyatt help.

Wyatt is your digital FAFSA advisor, texting helpful reminders and answering all your FAFSA questions.

Available 24/7. Free for students.